CAP : Add USDP-FRAX to the FRAX Omnipool

Summary :

The FRAX Omnipool is made up of three whitelisted pools: FRAX-USDC, GUSD-FRAXBP, and FRAX-3CRV. The total value locked is $2.96m at the time of writing.

This proposal aims to whitelist the USDP-FRAX Curve pool in the FRAX Omnipool.

Background :

USDP formerly PAX, launched in September 2018 by Paxos Trust Limited, is one of the first regulated stablecoins in the industry. USDP is pegged to the US dollar. PAX was rebranded USDP in August 2021.

USDP is backed 1:1 by US dollars held in FDIC-insured US banks, and an auditing firm regularly ensures that these bank balances and token balances are consistent through monthly attestations.

Paxos Trust Limited and USDP are both regulated by the New York State Department of Financial Services.

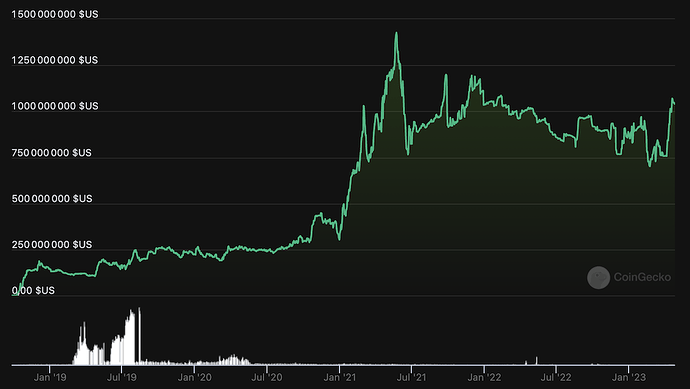

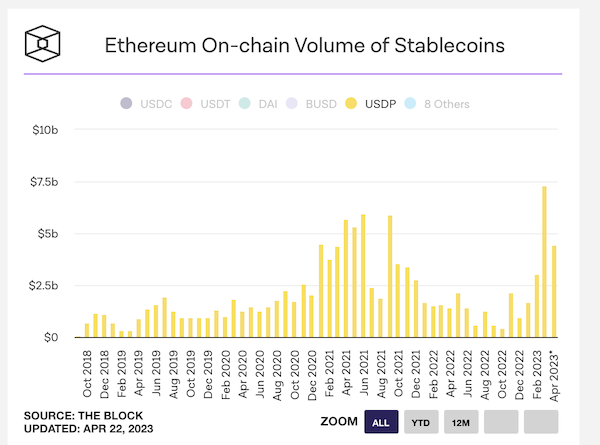

USDP has a total market cap of $1.04b and a price of $1. Ethereum on-chain monthly volumes of USDP oscillate between $1.3b and $2.5b since 2022 with a peak at $7.3b in March 2023. We can see that around 90% of daily volume is made on the USDP/USDT pair on Binance.

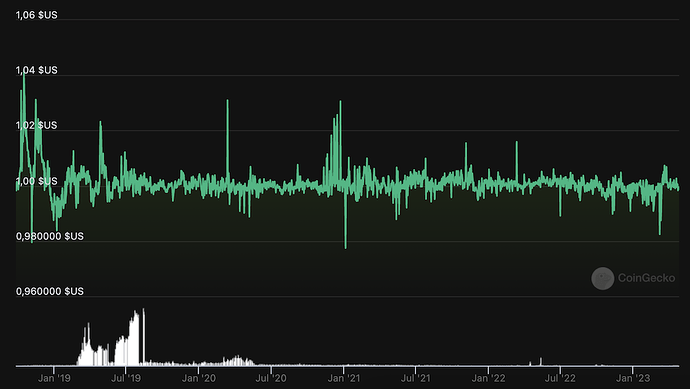

USDP peg has held strong during its existence as deviations from $0.98 occurred four times and lasted around 3 days. USDP is redeemable one-to-one at any time for Paxos customers. This allows for efficient arbitrage that protects the peg.

The FRAX-USDP Curve pool, created on April 7, 2023, is made up of 42.5m USDP and 38.3m FRAX bringing the TVL to $80.3m at the time of writing.

The data is still young but the volumes are decent on the pool, as shown by its Curve base vAPR of 0.54% which puts it in the top tier of stable pools of this size.

Rationale :

We will certainly see continued incentives for USDP-FRAX due to Paxos and Frax’s desire to make it the primary source of liquidity for USDP on-chain, as well as one of the major FRAX pools.

The current yield is 3.7% with a projection of 3.94% on Convex. This would place the USDP-FRAX pool as the second highest yielding pool on the Frax Omnipool.

USDP fulfills the requirements thanks to its verified Chainlink price feed and Curve pool liquidity of over $10m.

https://curve.fi/#/ethereum/pools/fraxusdp/deposit

Risks :

USDP depeg on the downside : as long as the dollars backing UDSP and held in FDIC-insured U.S. banks are sufficient and quickly accessible, arbitrage can be done by buying USDP below $1 on the open market and redeeming it for $1 via Paxos.

USDP depeg on the upside : USDP can be minted 1:1 by Paxos customers. If the USDP price is above 1$ in the open market, they can sell it to profit from the difference.

Voting :

In order to be implemented, this proposal requires a majority in a specific snapshot vote.