As outlined in our Discord announcement last week, Conic Omnipools are nearing launch as the protocol will soon be undergoing a formal security audit. With this being said, it’s time to initiate protocol governance and start unlocking the power of vlCNC. In this post I’ll provide an update of the Conic DAO’s upcoming voting schedule along with an outline of how vlCNC voting power works.

DAO Votes

If you haven’t already, join the Conic snapshot. This month will be an important time for vlCNC holders who will be able to decide on the initial Omnipool parameters. These upcoming DAO votes are described by the following schedule:

-

Dec. 6th: Underlying assets: This vote is to decide which underlying assets should have Conic Omnipools at launch. Note that only USD pegged assets will be included in the vote. Also, only assets that have at least two usable Curve Pools with significant TVL are included. Conic Omnipools for non-USD pegged assets such as

ETHandWBTCcan be added later via separate votes following the launch of Omnipools. A pool must receive at least 50% support (i.e. 50% of votes) to be included for launch (pools can always be added again later). At least one asset must be supported, if no assets receive support of at least 50%, the asset with the highest vote will be the only one supported. - Mid December: Whitelisting Curve pools: For each Conic Omnipool (e.g. USDC, USDT, etc.) there will be seperate votes that decide which Curve pools are supported for them (i.e. which pools on Curve can receive allocations of liquidity held in specific Conic Omnipools).

- Shortly before Omnipool launch: Liquidity allocation votes: There will be multiple separate votes at this time which decide the initial weights for each Conic Omnipool. That is, how liquidity will initially be allocated across different whitelisted Curve pools. Once Conic Omnipools are live a liquidity allocation vote (LAV) will be hosted every two weeks.

vlCNC voting power

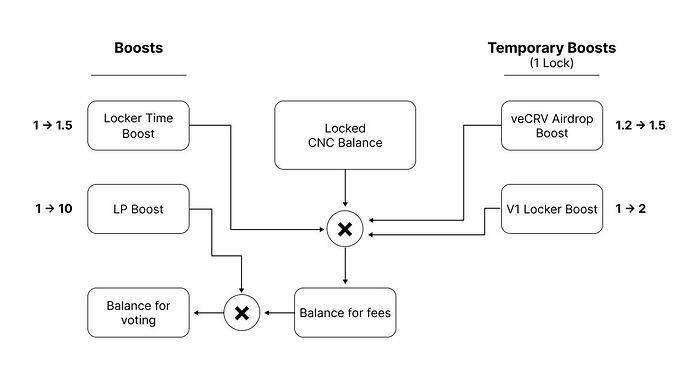

With the initial DAO votes coming soon it’s important that community members participating in governance understand how vlCNC boosts will work. Here’s an outline of how airdrop boosts will work (temporary boosts) along with normal boosts that will be applied once the v2 locker is live.

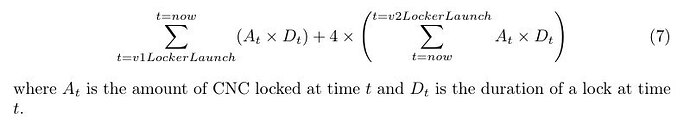

The v1 locker boost is calculated as:

Boost ranges:

- v1 Locker Boost: 1 → 2 (multiplied by CNC balance)

- veCRV Airdrop Boost: 1.2 → 1.5 (multiplied by CNC balance)

- Lock Time Boost: 1 → 1.5 (multiplied by CNC balance)

Boost Dependencies:

- Lock Time Boost: Increases across the boost range based on the lock duration (4-8 months)

- veCRV Airdrop Boost: Increases across the boost range based on how much veCRV one holds

The boosts above all factor into the vlCNC-fees balance which is used to calculate fee earnings. The LP boost (as described below) only factors into voting power and does not grant extra fee earnings:

The LP Boost is calculated as follows:

(1 + 50 * share of TVL) * time_weight where the time_weight increases from 0 —> 1 over the period of 1 month to incentivize LPs to stake their LP tokens for longer periods and to protect against flash loan attacks.

LP Boost range

- LP Boost: 1 → 10 (multiplied by vlCNC-fees balance to get the vlCNC-vote balance which is used in voting)