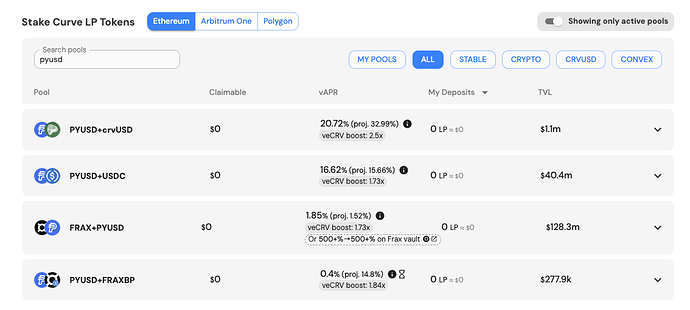

This proposal is to whitelist the PYUSD+USDC Curve pool (PayPool) for the Conic USDC Omnipool. The Conic USDC Omnipool currently has $7.2m TVL and is allocating liquidity to the following Curve pools:

- USDC+crvUSD

- DAI+USDC+USDT

- FRAX+USDC

At a current TVL of $37m PYUSD+USDC meets both the oracle and TVL requirements to be whitelisted to receive liquidity allocations from a Conic Omnipool. Furthermore, when staked on Convex, PYUSD+USDC yields over 13%. Therefore, the addition of PYUSD+USDC into the Conic USDC Omnipool, while increasing Omnipool diversification, would also increase the average APR for LPs as PYUSD+USDC is a significantly higher yielding pool than both DAI+USDC+USDT and FRAX+USDC.

Background

PayPal USD (PYUSD) is PayPal’s stablecoin, issued by Paxos. Fully backed and regulated | 1 USD : 1 PYUSD. Paxos-issued stablecoin PYUSD – and its reserves – are subject to strict regulatory oversight by the New York State Department of Financial Services. Reserves are held 100% in US dollar deposits, US treasuries and cash equivalents – meaning that customer funds are available for 1:1 redemption with Paxos. Customer assets are also protected from bankruptcy and fully segregated from corporate assets. The Paxos-issued reserve reports and attestations for PayPal USD are published monthly. Attestation reports are issued by WithumSmith+Brown, PC, an independent third-party accounting firm. Withum’s examination is conducted in accordance with attestation standards established by the American Institute of Certified Public Accountants (AICPA).

PYUSD is a USD-backed stablecoin on the Ethereum blockchain. Stablecoins are a type of cryptocurrency designed to have a steady value over time relative to a reference asset, for example, the U.S. dollar. They can provide inclusive, broad access to the financial system and can enable fast and efficient money movement. Stablecoins are programmable, offering developers a useful digital currency that can be built into public blockchains and can help link the traditional economy and Web3.

Paxos is the leading regulated blockchain infrastructure and tokenization platform. Its products are the foundation for a new, open financial system that can operate faster and more efficiently. Today, trillions of dollars are locked in inefficient, outdated financial plumbing that is inaccessible to millions of people. Paxos is replatforming the financial system to enable assets to instantaneously move anywhere in the world, at any time, in a trustworthy way. For more information, visit paxos.com.

Please don’t hesitate to follow up with questions or comments whether here or through DM, we’re always interested to talk to participants in the space and look forward to this expansion of usability within the Conic ecosystem.